There are no items in your cart

Add More

Add More

| Item Details | Price | ||

|---|---|---|---|

Fri Nov 21, 2025

Many people believe investing is something only the wealthy do. But in reality, investing is for everyone — not just those with “extra money.” Whether you earn ₹10,000 a month or ₹10 lakh, investing is what protects your future. If you avoid it, the cost can be far greater than you imagine.

Why You Must Invest — Not Just Save

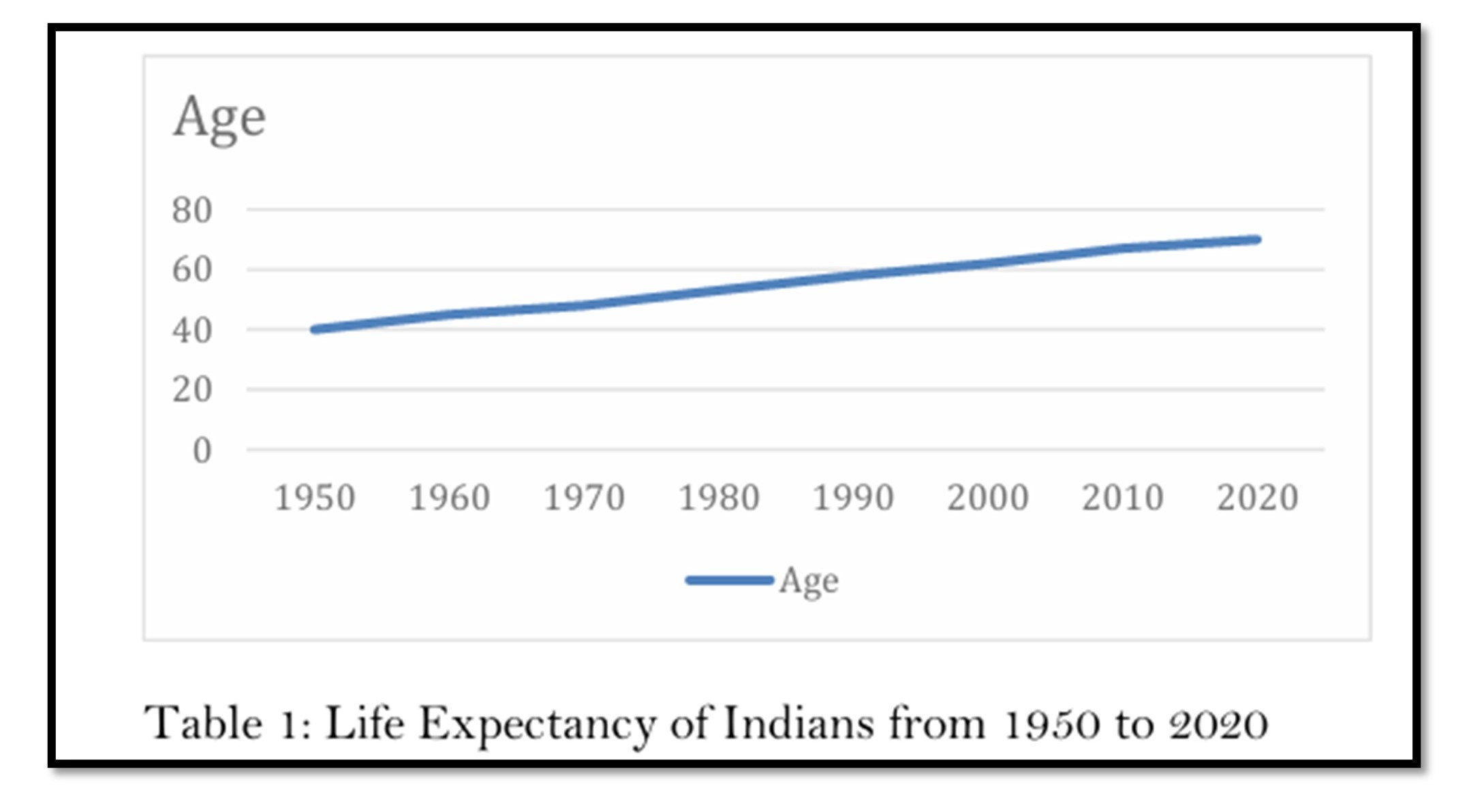

1. We’re Living Longer — Which Means We’re Spending Longer

Did you know?

2. Medical Emergencies Can Destroy Wealth

Medical Emergencies Can Destroy Wealth Here’s a painful statistic: as per Niti Ayog report Over 5 crore Indians fall into poverty every year because of medical emergencies.

One illness One surgery, One hospital stay That’s all it takes to wipe out years of savings. Even health insurance doesn’t always cover everything — medicines, tests, follow-ups, and income loss during recovery add up quickly. Investing builds a cushion so life’s shocks don’t break your finances.

3. Inflation: The Silent Threat

Inflation doesn’t take money from your wallet — it silently reduces its value. If inflation averages 6%, then in 12 years: ₹1,00,000 becomes only ₹53,000 in today’s value. That means you lose half your purchasing power without spending a rupee. That’s why saving alone isn’t enough.

Your money must grow faster than inflation eats into it. How? By investing smartly and consistently.

4. Future Expenses Are Guaranteed — So Prepare for Them

Some expenses are not surprises:

The good news? You have time to prepare. Start early. Invest regularly.

And to a typical Indian question — “What’s the guarantee we will live another 20–30 years?” Simple:

The problem is not dying early.

The real problem is living long without financial preparation.

CA Bijo scaria

Chartered Accountant, Author and Speak of Long Term Investments